Market Context

Market context :

- Week and Month up trend.

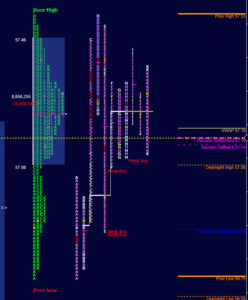

- 3-Day Balance ( 55.66 - 57.92 ).

- Yesterday's prominent POC ( 10 TPOs )

- Yesterday last distribution high/low considered as a day profile ( 56.54 - 57.11 ).

Inventories :

- Overnight : Long

- Yesterday's short-term traders : Slightly short.

Opening characteristics :

- Inside yesterday's range and value.

- Low conviction

Market Trading day

My early focus was set to yesterday's last distribution high/low ( 56.54 - 57.11 ). As we traded many times through the open in "A" period the early conviction was considered as low. Here is how I was thinking at "C" period open. In "C" period if we trade above the intraday high at 57.05 it will migrate the intraday POC higher increasing the odds of a good breakout. The breakout would be against yesterday's short-term short inventory and with the medium to long term market trend. If the breakout fails, another opportunity would present itself at the intraday POC level. This is what happened. We traded above the intraday high ("A" period high 57.05 ) and the breakout was a clean one. Now remember that the early conviction was low and overnight inventory was long. If we don't see continuation ( monitoring for continuation ) take profit just don't hope it will continue forever. That happened in "E" period when we left a poor high. Now long liquidation was the expectation. A buy order was placed at the intraday POC which was filled in "E" period low. I was not aggressive in my buying location because of the market volatility and the expected long liquidation. POC kept on migrating higher in "F" period but the market stalled there for the rest of the day. Pro Suite software also showed lots of weak buys ( "E"(3), "H"(1) ) reinforcing the weakness of this up day. The market has been very volatile lately offering good trading opportunities with excellent risk-reward ratios but it also showed that you have to step back and have an holistic view to be able to compete in this trading environment.

Tomorrow's heads-up :

- Prominent POC at 57.24.

- Weak buys throughout the day.

- Poor High.

- Poor Low.

- Inside Day.

Good Trading !