Market Context

Market Context :

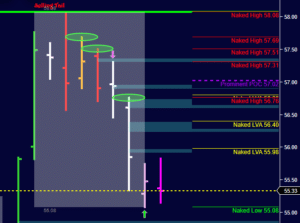

- Monthly and weekly up trend

- Day balance ( 8-day)

- 3 Poor Highs ( 9/11, 10/11, 14/11 )

- 2 Poor Lows ( 30/10, 2/11 )

- Yesterday's prominent POC

- Buying tail from yesterday

- We opened near the day balance low

Inventories :

- Overnight : short ( pivot 55.54 )

- Short term traders : short ( pivot 55.77 )

Opening characteristics :

- Inside yesterday's range

- Conviction : low

Market Trading day

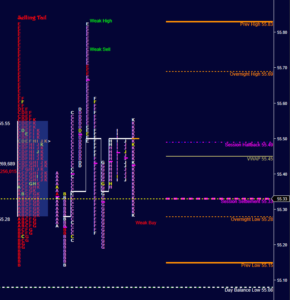

On the open my levels I was focusing on was the overnight short inventory pivots at 55.44 and 55.77 as well as yesterday's low at 55.08. We opened at 55.37 below the pivot levels so the market was short and comfortable. The initial move was down but the market was moving really slowly and the fact that the overnight inventory was short, yesterday's buying tail and yesterday's prominent POC put the odds on the long side of the market. Buying as close as possible to yesterday's low with a stop somewhere below yesterday's low was the first opportunity.

The market reversed at "B" period low and forced overnight traders to cover their shorts up to Tuesday POC at 55.77 which was the last short term traders short accumulation level. Short term traders protected their position leaving a selling tail rejecting the short term inventory pivot and reinforcing the day down trend inside the balance. ( last 5 days one time framing down - see image on the left ) That level could have been a good opportunity to reverse position. Remember that 55.77 is a short term resistance ( short term traders inventory short and comfortable ) and today's developing value was overlapping to lower and it would have taken a huge move up to bring value to unchanged. The market traded back down bringing the POC down in "G" period and yesterday's low came into play for a second time. The story of the day was probably the overnight short covering that pushed the market from its low to its high. That was close to a balance day as we traded mostly inside yesterday's range. Today I can see at the most three opportunities Things to consider for tomorrow : We are accumulating short inventories here at the low of the 9-Day balance. We have to be ready for a possible big move because of the market location at the low of the day balance.

Good Trading !