Market Context

Market context :

- Monthly and Weekly up trend.

- 6-Day Balance ( 55.66 - 57.92 ).

- 3 Poor Lows ( 30/10, 2/11, 6/11 ).

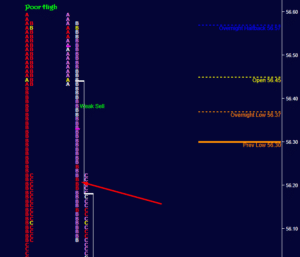

- 2 Poor Highs ( 9/11, 10/11 ).

- Yesterday's Prominent POC ( 56.86 ).

Inventories :

- Overnight : Short ( pivot : 56.60 ).

- Yesterday's short term : Slightly Short.

Open characteristics :

- Open inside yesterday's range near yesterday's low.

- Conviction : Medium.

Market Trading day

At the open the market offered a good opportunity to sell around the overnight inventory pivot at 56.60. The stop should be very tight just above the overnight inventory pivot because of the tendency for the market to clean the overnight inventory early in the morning before taking its real direction. The odds of value developing lower was really good.

The break out of "A" period low started this down trend and we never looked back. It was very strong confirmed by high volume. The 6-Day balance low at 55.66 was the ultimate target and well in reach. When we are facing a strong trend, the opportunities to enter with the trend happen very quickly and we have to be very aggressive. The way that I deal with this situation is splitting my entries. The perfect situation is entering at previous bar high volume level if there is any. "C" period offered that opportunity at the "B" high volume range ( 56.20-56.25 ) as shown by the Full-Split display from Pro Suite software from the image on the left.

Markets are always looking for a two way trading area and we found that area around the 55.52 level. After finding some value around that level my trading range was set to 55.28 the "D" period low and 55.81 the previous intraday POC level before migrating higher in "I" period. The market traded inside that range for the rest of the day and closed slightly above the 6-Day balance low expanding the 6-Day balance to a 7-Day balance. The new balance low level ( 55.18 ) will be very important for tomorrow's trading. The key successful minding set today was going with the inventories when we traded just below the overnight inventory pivot this morning. The risk was small and reward was very good. I was ready to sell up to yesterday's POC. The reason being the lower developing value with low short covering probability. Inventories... Inventories... Inventories

Good Trading !