Market Context

Today's Context General :

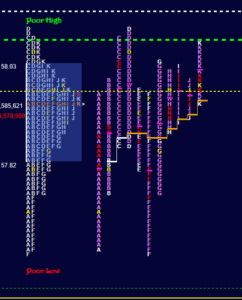

- Monthly up trend.

- Weekly - Confirming week ( 58.08 ).

- Daily - Confirming day ( 58.14 ).

- Yesterday's poor low

- Yesterday's selling tail

Inventory :

- Short term traders long. ( Pivots : 58.11 and 57.71 )

- Overnight short ( Pivot 57.75 )

Opening characteristics :

- Open inside and at bottom of yesterday's range.

- Conviction : Bullish - Medium.

Market Trading day

There was an opportunity to go against the overnight inventory when we traded above today's open. The overnight pivot level was set at 57.75 and the market open was 57.72. The first move was down, found no real selling and we traded back through the open. That was when the opportunity happened. The target was yesterday's POC at 58.11 and last Thursday low at 58.14. Value was building inside yesterday's value so unchanged value which put even more credibility to the long position at 57.73-75 level. Monitoring for continuation was crucial. "B" period made a new high and it was a poor and a weak one ( traded 1 tick from yesterday's halfback ). "C" period made a new high and POC started migrating up. I decided to take profit at 58.05 because the tempo was getting slow up there.

We were very close to the original target that I had in mind. Analysing tempo comes really with a lot of screen time. There is no substitute for it. It is not always right but like anything else in trading we are dealing with probability here. I was not interested in looking for buys anymore even if the POC was migrating up, the reasons being that we were trading below yesterday's POC so short term traders inventory from yesterday was still caught in bad long position and short overnight inventory was considered as totally covered now. I was now expecting a rotating market below yesterday's POC. Intraday POC became prominent in " D" period. My trading range high was set to 58.08 and 57.55. We just rotated up and down as expected for the rest of the day. We are now facing a 2-Day Balance for tomorrow. ( 58.47 - 57.55 ).

Good Trading !