Market Context

Context for today : Long term :

- Monthly Chart bullish.

- Weekly Chart 3-Week balance ( 58.08-55.08 ) breakout. Need closing confirmation this week above 55.08.

- Daily Chart bullish.

Inventories :

- Overnight short

- Short term traders long

Opening characteristics :

- Gap down

- Conviction : Medium ( down side )

Market Trading day

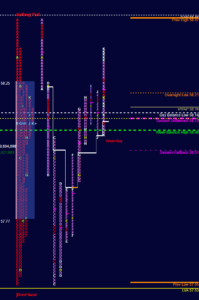

Gap rule was in play at the open. Rule 1 was in effect as we traded with slow tempo at Friday's low ( gap closing level ). We also left a High volume area at the 58.45-58.41 level. Short term traders longs from Friday and Thursday were really in trouble and they covered their position as price drop accelerated below 58.14. Possible first target was last Wednesday POC level.

Remember that the market was bullish as shown by the monthly and daily charts - so after cleaning weak long inventory the POC level from last Wednesday was a good support level to go with the trend. "C" period and "D" period lows created a poor low giving us some insight about a possible "too short" situation coming from overnight shorts from yesterday as well as new shorts added during today's session ( short term traders as well as day time only traders ).

The scenario was set for a short covering move as "D" and "E" period were inside bars and coupled with the a poor low was lowering considerably the odds of a down trend continuation and increased the odds of short covering. POC started migrating higher in "G" period confirming the change of tone for the day. Very rarely we will see markets going from short to long. Usually markets move from short to balance to short again or to long. This balancing period came from "D" and "E" period today.

Good Trading !