Today was an excellent learning day that I want to share with you. What I did wrong today... Market Context :

- Monthly up trend.

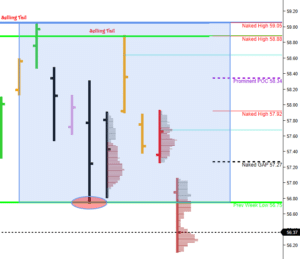

- Weekly 2 week balance ( 59.05 - 55.75 ).

- We are trading below current weekly and monthly POC.

- 8-Day balance ( 59.05 - 56.75 ).

- Poor Low at day balance low ( from 11/29 ).

- Prominent POC from 11/20 at 56.14.

- Oil inventory number at 10:30AM

Inventories

- Yesterday's short term traders : long ( pivot: 57.55 )

- Overnight : short ( pivot: 56.90 )

Opening characteristics

- Gap down

- Conviction : relatively low

Gap rule were in play at the open. I did not make money today and here's why : The 8-Day balance low was in play this morning and I focused on the long side as long as we were trading and staying above the balance low level at 56.75. I was just focusing on this - forgetting about the holistic view I should apply every day in considering the whole contextual factors. Thanks it doesn't happen to me very often though. Here are the key contextual factors that should have been part of the right mind set :

- Gap rule

- Long short term traders inventory ( from yesterday ) was in big trouble at the low of a 8-Day balance.

- As soon as we have shown intraday POC prominency confirming down developing value it was putting even more pressure on weak longs from yesterday.

Obviously inventory number coming in at 10:30 was adding emotional stress to all this. Considering these factors and weighing them accordingly would have made it clearer then that the short side was the way to go. I would like to talk about a nuance here that was also very important to be aware of. Look at the 8-Day balance from the Pro Suite day chart image. Have you noticed something ?

- What do we have at the balance high : Two selling tails ( from 11/27 and 12/1 ).

- What do we have at the balance low : A poor low from 11/29 ( the ellipse ).

Seems that selling was stronger at the balance high and buying was weak at the balance low. Because I put all my focus on the wrong factor ( coming from the wrong analysis ) I was out of sync with the market and not only did I lose money but I also lost a very nice opportunity to make a lot of money ! Once the market starts a trend it is very difficult to join it, you have to be patient and try to avoid one of the biggest trap - running after the market. The down trend ended at the Prominent POC level from 11/20 which should have been the target if you were short. It happens to turn into a double distribution day and the only real selling opportunity left was offered at the top of the lower distribution in "J" period. Volume in "D" "E" "F" and "G" periods ( new money coming in ) was high giving a good reason to still look at the short side.

Good trading!