Market Context

Please note that this blog is based on a concept called retrograde analysis, It is not about where to buy or where to sell but how we should train our mind in order to use Pro Suite in the most efficient way to get the best overall profitability. Retrograde analysis is a technique that helps you to predict events by working backwards from the outcome. Market Context General

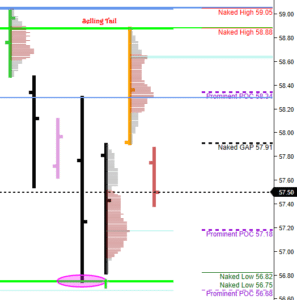

- Monthly up trend

- Weekly balance. 2-Week balance ( 59.05- 55.75 )

- Daily - Transition day

- Poor Low from 11/28.

- Prominent POC from 11/30 ( 57.18 )

Inventories

- Short term traders from Friday : short ( pivot 58.38 )

- Overnight : short ( pivot 57.95 )

Open characteristics

- Gap down

- Conviction : Low

Market Trading Day

Biais on the open was on the short side based on inventories. We opened well below the inventory pivots from short term and overnight traders. Gap rule was also in play. "B" period high did not fill the gap with slow tempo. Notice that value was developing well below Friday's value and it would have taken a huge move up to bring value unchanged. The gap level with price staying below overnight inventory pivot offered a very good risk-reward ratio on the short side. "D" period started to show intraday POC prominency increasing the probability of rotation. Even if POC was migrating down with value developing lower, singles and doubles should be on our mind specially when all inventories are short and we keep on trading back inside the overnight range. My trading range for the day became the gap level at 57.91 and the Prominent POC from 11/30 at 57.18. Only prices around these levels would attract my attention. The market rotated up and down for the rest of the day. Tomorrow I will consider the day time frame as being in a 7-Day balance area ( 59.05 - 56.75 ).